A conversation with Malini Ram Moraghan

Malini Ram Moraghan is the founder and managing director of the Torana Group, an impact investment firm that helps family offices and foundations invest in their convictions. The firm invests in ways that regard “expendable” resources — like soil, water, labor — as essential drivers of value. Torana’s capital helps enterprises grow responsibly and share value in ways that improve business stability and resiliency in the face of the turbulence of the 21st century. Its Essential Owners Fund is investing in three sectors: food and agriculture, senior living, and childcare, with a focus on improving employees’ economic stability, protecting company operating continuity, and preserving enterprise value. Employee ownership is one of several strategies the fund uses to improve outcomes for stakeholders like workers.

Through an email exchange, Moraghan shared her thoughts on Ownership Works and the role of private equity in expanding employee ownership with Employee Ownership News. An edited version of our email exchange appears below, as part of our series exploring these questions.

EONews: What was your reaction to hearing the news of Ownership Works (OW)?

Malini Moraghan: My first thought was that sectors don’t expand in clear linear ways; instead, expansion comes in messy, turbulent fits and spurts. This feels like a time of messy growth for employee ownership.

I firmly believe the employee ownership space is ripe for innovation and expansion, so I both welcomed the splash that OW brought to shake up a relatively cloistered space; and I immediately have open questions about who and how new shared ownership structures will serve stakeholders (including shareholders).

However provocative it is, the KKR ‘shared ownership’ vehicle has shaken up the options, even if what they are offering is not the same thing as long-term, programmatically engaged employee ownership.

The news of KKR’s exit from C.H.I. Overhead Doors provides exciting and provocative fodder for this discussion. There are key questions to ask and answer: for example, What portion of the total return went to workers? Did the workers get sprinkles and no cake? Are big sprinkles better than nothing, and for how long? How will this method of sharing private equity (PE) returns create a meaningful shift in overall socio-economic stability? Can PE-issued equity grants create sustained wealth for employees? That remains to be seen. Many people are looking for more on how to bridge between the kind of equity grants KKR made in C.H.I. and the broader outcomes our economy needs, like sustained economic stability for the workforce. I generally think it’s a good sign of evolution when the questions get harder and more complex.

This development has also made me ask other key questions related to our investment thesis and the sector’s growing activity. At Torana, one long game we’d like to contribute to is ultimately to lower the cost of capital for these transactions, thereby making it cheaper and cheaper for employees to assume ownership stakes. That is going to take different kinds of capital and policy working together.

When you say the employee ownership space is ripe for innovation and expansion, what do you mean by that?

The ESOP has been a great stalwart for good reason; its efficacy for both companies and employees is well documented and its evolution and expansion should continue where the structure is an appropriate fit. Additionally, we need a proliferation of new policies and structures to make it much easier for owners and founders to share, gift, offer, transition, and extend ownership to employees and gig workers who drive a company’s value. I’d love to see a database on new vehicles and structures to help us expand legitimate employee ownership options beyond the ESOP.

Our fund takes a pragmatic approach to applying ownership as a tool for both stabilizing the lives of frontline employees and strengthening the business enterprise. I talk to many business owners in the course of our work, and I can honestly say that those of us out there “selling employee ownership” need more tools and structures in our toolkit for these conversations. However provocative it is, the KKR “shared ownership” vehicle has shaken up the options, even if what they are offering is not the same thing as long-term, programmatically engaged employee ownership. I’m just glad to have another model to be able to reference in conversations with owners. And I want still more models.

Has the announcement of Ownership Works and its plan to expand equity shares for workers had an impact on the conversations you are having with family offices?

I can’t tell you how many people sent us the articles on KKR’s exit from C.H.I. Overhead Doors, which was announced in the middle of May. For Torana Group, this is a net benefit, largely because it is highly visible activity that is reaching new audiences. It is doing the work of educating investors for us by providing an extraordinary social validation in private investment spheres. We’ve heard things like “KKR is in this space, so your thesis must really be onto something.”

Without question, there are better ways that private equity owners can engage, value, and govern with the workforces that power their portfolio companies.

As a relatively new entrant ourselves, we’ve entered this space with a humble regard for the stalwart ESOP and are trying to innovate structures that offer owners options in addition to ESOPs. I welcome both Ownership Works’ activity and the robust dialogue that comes with acknowledging tradeoffs and questions. For example:

- How does the OW/KKR model promote long-term economic stability for frontline workers? A windfall is very meaningful in this current environment, and it is also temporary; what is the path between $200,000 checks to a small group of drivers and shifting economic stability for an entire segment of the economy?

- How will the various firms partnering with OW be held accountable for what they pledge? Having seen the relatively limited impact of voluntary goals around climate change, I’m skeptical that there will be significant follow through without regulatory change. I look forward to how OW will also work on the policy and regulatory front.

- Sharing vs. compensating? Broadly, and beyond OW, I have questions about how ownership gets framed. Sometimes it is framed as a bonus, sometimes as an essential component of compensation. We have a core issue that essential workers are not appropriately compensated for the value they create within a business. We saw during COVID how undervalued these workers are, how there’s a mismatch between their total compensation and the role they play in ensuring business operating continuity. Sharing should be in addition to fair compensation that allows for stable livelihoods, not in place of it.

Can traditional private equity be a vector for responsible change, particularly for labor?

There is not a simple, single answer to this question. A small handful of PE firms are working for responsible change, and a new generation of private investment firms are forming to focus on responsible growth. Smart capital providers see the connection between risk management, workforce engagement, and workforce participation in governance.

It’s important to ask, by sharing equity more broadly with employees, what outcome is being sought? Is the intention to expand who gets to participate in the upside of the business? Is equity a pathway to governance? How the equity is structured makes all the difference — it can be structured to optimize benefits for marginalized stakeholders, or it can be structured in ways to prevent things like participation in governance.

Without question, there are better ways that private equity owners can engage, value, and govern with the workforces that power their portfolio companies, especially the companies in essential industries. For someone who only cares about return, I’d say it’s untapped value they are missing; for someone who can see the larger picture and cares about impact, I’d say that it’s an imperative to help stabilize daily life and dignity for the majority of our citizens.

It feels like the changes you are talking about are at the margins of the private equity industry. Even Ownership Works, which has $50 million in philanthropic funding behind it, is working with a handful of firms to change the model. What can be done to push more systemic change?

Evolution of regulation of the PE industry at large is the big lever for change here. Private equity firms are not measured, structured, or held accountable for their impact on the economic stability of their portfolio company labor forces. Until that changes materially, I don’t see much changing with regards to how PE owners engage portfolio workforces. When PE firms are mandated to start disclosing more human capital metrics to their limited partners (LPs) and regulators, when LPs start making allocation decisions based on these metrics, then we might see a path to meaningful change for economically stagnant and marginalized communities.

If private equity is going to move in this direction, what would you like to see happen to ensure a more positive impact on workers, jobs, wealth distribution, and communities?

I’d love to see PE firms be subject to SEC-mandated reporting on human capital metrics — much of that data is already being captured and analyzed. Groups like the Human Capital Management Coalition are actively working on advocating for more workforce data disclosure. I’d also love to see — as a baseline — workforce representation on all PE portfolio company boards, not unlike what we see in Europe. This kind of board diversity lends itself to healthy governance and good enterprise management. I’d like to see investors (private equity and others) working backwards from what is meaningful to different segments of workers and solving across different tools, perhaps even combining the powerful asset development of ESOPs with structures that provide some cash and liquidity now.

At this moment, it’s too early to tell whether PE firms sharing ownership is too little too late to address the yawning U.S. economic divide that is destabilizing our society or if this might be the start of a tidal shift towards rewiring private equity industry economics to work for greater public benefit and a healthier economy that lifts the baseline for many. I’ll hope and work for it to be the latter.

To follow Employee Ownership News, subscribe to the Fifty by Fifty newsletter.

Is Private Equity about to Co-opt Employee Ownership?

What the launch of the nonprofit Ownership Works could mean to the employee ownership movement.

Continue Reading Is Private Equity about to Co-opt Employee Ownership?

Are the Barbarians at the Gate?

Part 1: Can private equity be trusted to prioritize worker benefit?

Ian MacFarlane: Can we call this “employee ownership”?

It seems they’re doing what big capital does: take over a concept like employee ownership and make it their own in order to make more money.

Continue Reading Ian MacFarlane: Can we call this “employee ownership”?

Jim Bonham: Enter the Dragon?

Making modest investments to a non-profit in order to take shelter from the negative public sentiment resulting from the massive and growing wealth inequality in America is a cheap way to diffuse heat.

Are the Barbarians at the Gate?

Part 2: If equity shares increase workers’ productivity, who benefits?

Delilah Rothenberg: A step in the right direction, but only one piece of the puzzle

As long as the wealth of GPs grows exponentially faster than that of everyone else, economic inequality will continue to grow.

Continue Reading Delilah Rothenberg: A step in the right direction, but only one piece of the puzzle

Ian Mohler: A Piece of the Pie Is Better than No Slice at All

Offering equity to workers is a good thing, and we can argue later about what share of the pie is most appropriate.

Continue Reading Ian Mohler: A Piece of the Pie Is Better than No Slice at All

Are the Barbarians at the Gate?

Part 3: Is this real employee ownership?

Joseph Cureton: Success is more than an increase in financial value

I see this as an opening, an opportunity for the idea of worker ownership to become more mainstream.

Continue Reading Joseph Cureton: Success is more than an increase in financial value

Andrea Armeni: An Opportunity to Spur Deep Structural Change

Ownership Works can be a conversation starter and spur conversations about who is creating the value and who should capture it.

Continue Reading Andrea Armeni: An Opportunity to Spur Deep Structural Change

Andrea Dehlendorf: Working with Private Equity to Make Jobs Better

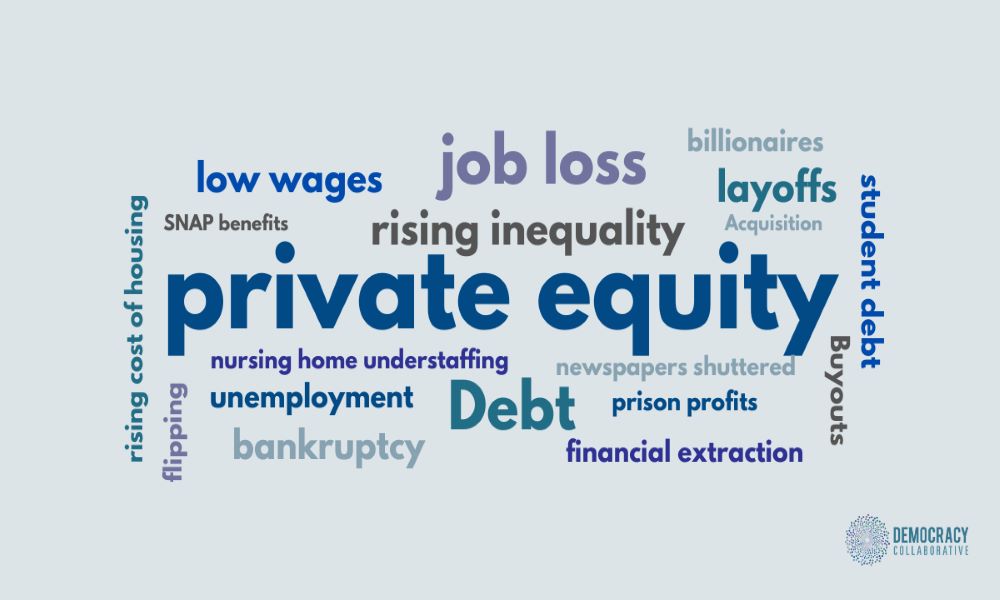

Americans need to better understand the role of Wall Street and private equity in our economy.

Continue Reading Andrea Dehlendorf: Working with Private Equity to Make Jobs Better