Ian Mohler is a partner at Mosaic Capital Partners, a private equity firm using an employee ownership buyout strategy to empower workers and offer sellers an opportunity to maintain their legacies and impact their communities during a change-of-control transaction. We asked Mohler about how the differences between Ownership Works and the employee buyout strategy that Mosaic has championed.

Making the PE model more inclusive

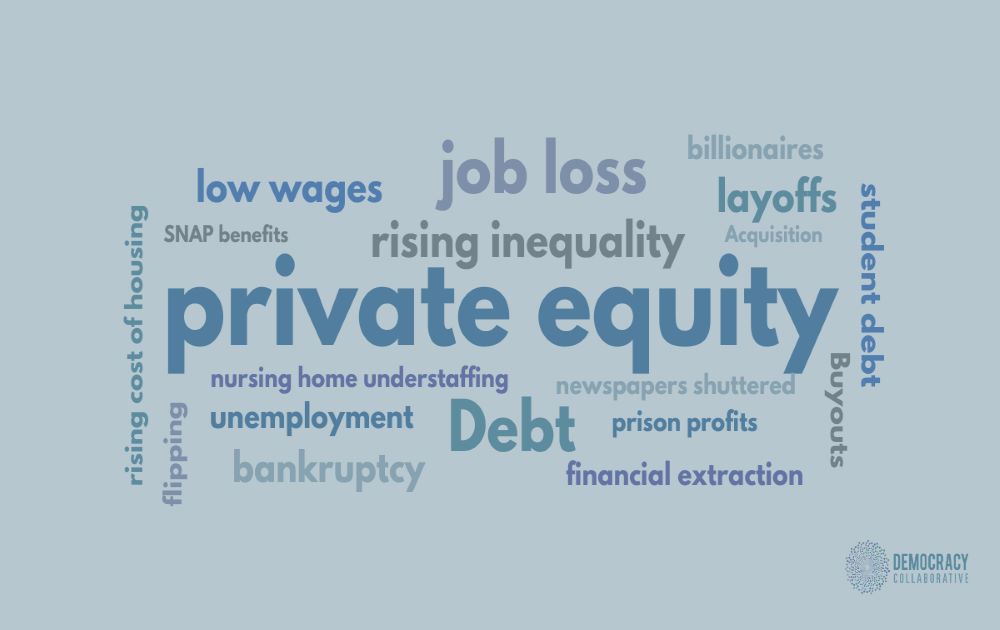

Traditionally, change-of-control transactions have increased wealth disparities. It is good to see KKR acknowledge that: traditional private equity transactions generate immense wealth for the management team and the investors, but the average worker sees none of that.

This is a good thing, and we can argue later about what share of the pie is most appropriate.

KKR has proposed a new model, in which workers get a piece of the pie. They have expanded the traditional private equity model, in which a stock options pool of 10 to 15 percent is set aside for a handful of top leaders on the management team; they are now saying they will include the entire workforce, which could range from several hundred to more than a thousand individuals. But the disparities remain: that handful of managers get 15 percent of the equity, while a thousand workers get 5 percent; investors still hold the vast majority of shares. Nonetheless, this is a good thing, and we can argue later about what share of the pie is most appropriate. A piece of the pie is much better than no slice at all.

Limits to worker agency

One big difference between the Ownership Works model and Mosaic’s model of transitioning the company to an ESOP is the company’s governance structure. In the case of the Ownership Works model, KKR (or another buyout fund) owns the company and makes all strategic decisions including when to sell it. Workers have very little agency in that model.

When we create an ESOP, the board of directors is outside controlled and the only shareholder is an ESOP Trustee who is a fiduciary to the employees. Any decision to sell the company has to be approved by these entities, which have a fiduciary responsibility to the business and the workers. In addition, the employees have a much greater wealth creation opportunity in an ESOP model since the ESOP typically owns 100 percent of the company compared to approximately 5 percent ownership in the Ownership Works model.

Read our entire series on Ownership Works and the impact of private equity on the employee ownership field.

Is Private Equity about to Co-opt Employee Ownership?

What the launch of the nonprofit Ownership Works could mean to the employee ownership movement.

Continue Reading Is Private Equity about to Co-opt Employee Ownership?

Are the Barbarians at the Gate?

Part 1: Can private equity be trusted to prioritize worker benefit?

Ian MacFarlane: Can we call this “employee ownership”?

It seems they’re doing what big capital does: take over a concept like employee ownership and make it their own in order to make more money.

Continue Reading Ian MacFarlane: Can we call this “employee ownership”?

Jim Bonham: Enter the Dragon?

Making modest investments to a non-profit in order to take shelter from the negative public sentiment resulting from the massive and growing wealth inequality in America is a cheap way to diffuse heat.

Are the Barbarians at the Gate?

Part 2: If equity shares increase workers’ productivity, who benefits?

Delilah Rothenberg: A step in the right direction, but only one piece of the puzzle

As long as the wealth of GPs grows exponentially faster than that of everyone else, economic inequality will continue to grow.

Continue Reading Delilah Rothenberg: A step in the right direction, but only one piece of the puzzle

Are the Barbarians at the Gate?

Part 3: Is this real employee ownership?

Joseph Cureton: Success is more than an increase in financial value

I see this as an opening, an opportunity for the idea of worker ownership to become more mainstream.

Continue Reading Joseph Cureton: Success is more than an increase in financial value

Andrea Armeni: An Opportunity to Spur Deep Structural Change

Ownership Works can be a conversation starter and spur conversations about who is creating the value and who should capture it.

Continue Reading Andrea Armeni: An Opportunity to Spur Deep Structural Change

Andrea Dehlendorf: Working with Private Equity to Make Jobs Better

Americans need to better understand the role of Wall Street and private equity in our economy.

Continue Reading Andrea Dehlendorf: Working with Private Equity to Make Jobs Better

Will Equity Shares Improve Outcomes for Workers?

This seems like a time of messy growth for employee ownership.

Continue Reading Will Equity Shares Improve Outcomes for Workers?

To follow Employee Ownership News, subscribe to our newsletter.